Payments

The current state of recurring payments.

Recurring payments shouldn’t be something to think about. The whole point of recurring payments is that they act silently in the background, generating revenue for your business month by month.

Then why has it caused so much headache for consumers and business for such a long time?

Let’s start from the beginning.

What does recurring payments mean?

A recurring payment is a transaction that repeats multiple times on a specific date range and is charged on a periodic basis.

This is what you need to know. Tap any item to jump straight to that content.

- How does it work in theory How can recurring payments benefit your business?

- What businesses can use recurring payments?

- What options exist

- Consider when selecting recurring payment methods

- Get started with a modern recurring payment

How recurring payment works.

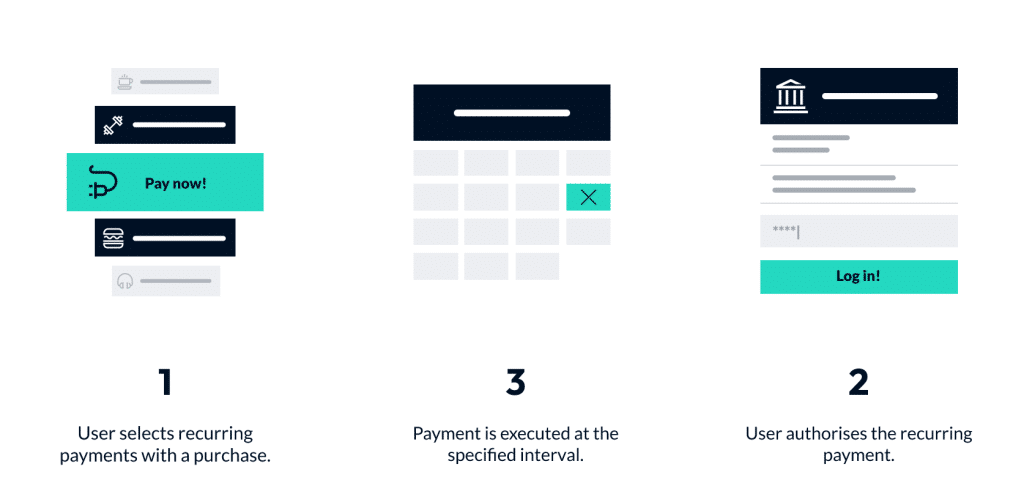

Without diving headfirst into the technical details, all recurring payment methods do more or less the same thing. It’s allowing you to collect payment on a recurring basis, often monthly, in an automated non-intrusive fashion. The customer gives informed consent to allow a payment initiator to withdraw a fixed or varying sum after a set of days or on a certain date.

The actual sum withdrawn from the account can either be predetermined, fixed, or be flexible, or variable.

Fixed recurring payments.

With fixed recurring payments, the customers are charged the same amount each time. Membership fees and streaming subscriptions are common examples of fixed recurring payments.

Variable recurring payments.

The consent for variable recurring payments is slightly different as the amount might change from period to period, based on usage or additions. This could be an electricity bill or a mobile phone subscription where the amount changes based on consumption.

How recurring payments benefit your business.

Whilst the benefits for the end-user might seem obvious, there are plenty of advantages for businesses that can adapt to or implement a recurring payment method. That’s regardless of if your business requires payments on a recurring basis, or if it can find new strategic ways to do so. Magazine subscriptions might be an obvious one, but what about subscribing to underwear or cars? More on that later.

- Reduce late payments

- Save time

- Improve customer relationships

- Fraud protection

- Less guesswork for budgeting

- Speedy transactions

Reduce late payments.

Late payments are the worst. It affects your cash flow and might also affect your customer relationship. To spend less time chasing late payments and annoying the clients or asking them for extra fees, you can set up a recurring payment. Once it is in place the withdrawal is automatic and on time. It’s not waterproof, as there must be a balance on the account or the selected card must be valid.

Save time.

Manual invoicing or payment processing can be a tedious, time-consuming task. Not to mention boring. If a recurring payment stays active and unchanged, that administrative work is removed from the equation, meaning less manual, boring, expensive work. It’s not a self-playing piano, and some handling might be required for changes of amount, balance issues or new payment types.

Happier customers.

A happy customer is a good customer. If recurring payments make their everyday life better, they will regard your business the same way. With the recurring payment set up, the customers can lean back and relax, knowing that they don’t need to worry about reminders, being late on payments or having to enter payment details every time.

Fraud protection.

The payment gateways that store your customers’ consent and bank or card credentials are following strict rules for compliance. This ensures that the data your customers left is well protected, and that you can spend less time investigating and solving fraudulent transactions.

Less guesswork for budgeting.

Automated, recurring payments mean monthly revenue with a high degree of certainty, even when planning ahead. You are guaranteed a reliable cash flow, thus you can invest or plan for the future. You even have the possibility of setting recurring payments on a short period of time, like weekly or monthly, or discounting the cost for users signing up for a longer period like quarterly or yearly, making it an even more reliable source of income.

Speedy transactions.

As the payment is handled electronically and not by a human or manual process, there’s no delays when it comes to sending or receiving funds. If the customers’ account has balance or the credit card is valid, you will get paid on the day agreed on.

Businesses that successfully use recurring payments.

What’s the first type of business that come to mind when you’re thinking about recurring payments? Streaming services? Gym memberships? Electricity bills? Yes, yes and yes! But the subscription economy can cover much more than that. Here’s three use cases that might get your ideas flowing.

Nextory.

We know, offering loans on books is a business idea dating back thousands of years, but what companies like Nextory is doing is quite different. Except the fact that it’s all in the cloud, accessible on your phone, they can also let users adapt their experiences and their expenses.

For occasional listeners they offer a small plan for small fee, heavy users can stream audiobooks all day long for a fixed fee and families can share the experience for a discounted monthly fee.

The same principal idea, but with greater control and personalized options for all customers.

Volvo on demand.

Who needs to own a car these days when you can subscribe to hundreds of cars for a small monthly fee. Depending on how much you use said cars the monthly bill can vary. A few trips to the grocery store one month and a family vacation the other makes variable recurring payment a perfect fit.

Not only are Volvo transforming the way we (don’t) own cars and travel, but they are also using their subscription plans to create a better user experience for loyal customers. Infrequent users don’t have to pay a fixed monthly fee, but if you do you get better conditions.

Björn Borg.

Subscriptions don’t have to be expensive or technically advanced. Solving everyday issues are done by basically any company, where Björn Borg is a good example. Why occasionally sell packs of underwear when, instead you can get a steady stream of income and offer customers a mind free service. Happier customers, and more money on the bank.

While setting up the fixed recurring payment Björn Borg offers customers to set what design a customer prefer and how often they should be sent. Higher frequency is rewarded with a better deal.

What options exist?

When you see a need for recurring payments, you face a tough choice of different solutions. Looking beyond the hundreds of vendors, there are only a few types of methods. Those methods have some major technical differences.

Autogiro, Avtalegiro and similar.

For a long time (60 years in Sweden) bank services like Autogiro and Avtalegiro have been the common and preferred recurring payment method. Still today it’s used by businesses and governments across the Nordics. But, even if the tunes of Elvis’ classics are eternal, 60-year-old tech is not and in Sweden, autogiro is officially coming to an end, as it’s being superseded by P27.

And honestly, any payment method that requires you to print a piece of paper and sign it by hand, or manually inputting account and KID-numbers, are outdated and bound to lose traction.

P27.

Let’s just briefly touch on this solution, as we still know very little about its application. It will supersede companies like Bankgirot, but how it will work for businesses and consumers is uncertain. There’s a great risk that it’s going to be a hassle, as consent for autogiro can’t automatically transfer to another payment provider. (Updated September 7, 2022).

Card payments.

Card payments were never intended for recurring payments, and for businesses this is important to keep in mind. Each card transaction is pricey, and you run a risk on churn (losing customers) due to expiring, lost or stolen cards.

For global businesses cards can offer a great coverage. The hassle of manually entering card credentials is at least only done once or twice. If you’re a SaaS business, for instance, you can keep your users within your platform. That’s better than using external bank services in order to set up the payment.

There are two meals on the menu. One we recognize with a new seasoning, and one exciting chef-composed super dish.

Mobile wallets.

Apple, Google, Samsung and others are doing a great job modernizing the payments within their own platforms. Apple for one lets your customers setup a recurring payment with the push of a thumb.

It looks, and feels new, but it’s all based on card payments and inherit their flaws.

Recurring payments with open banking.

Open banking is simple, yet highly effective. As the banks open up their data with APIs, funds are moved from one bank to another without middlemen. As simple as that!

It becomes even more effective when we combine payments with dates or periods. Thus reinventing recurring payments! The setup for your clients is easy, integrated on your platform or in a standalone interface. No entering of manual numbers, no plastic card to break or lose. All safely encrypted and protected with Strong Customer Authentication (SCA).

As of this date there’s only one major downside with recurring payment using open banking technology. It is the lack of support for variable recurring payment. The fintech industry is eagerly awaiting these possibilities from the major Nordic banks.

Start using Finshark’s modern Recurring payments.

It should come as no surprise that recurring payments with Finshark are superior to any other payment methods available. For fixed recurring payments made within the Nordics, no other option is really needed.

Contact sales for setup or read our documentation on how to get started.

A perfect flow.

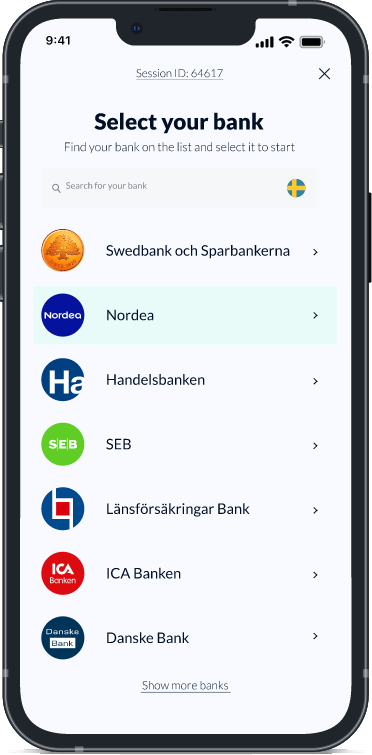

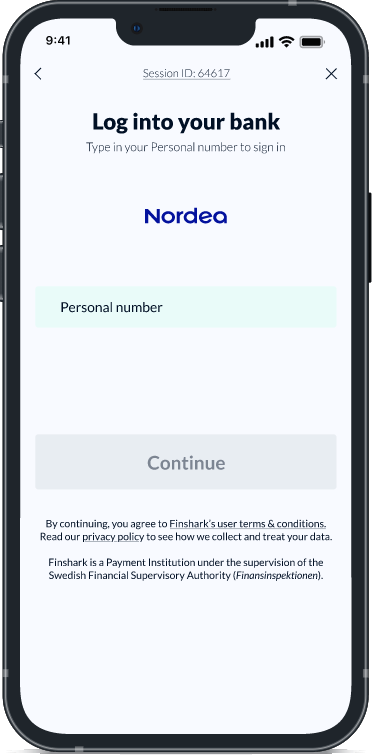

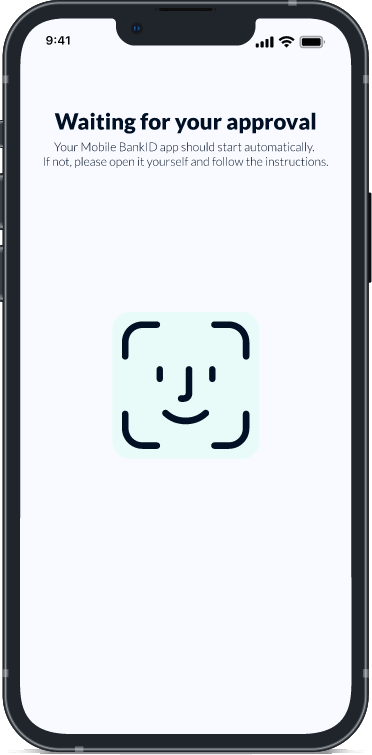

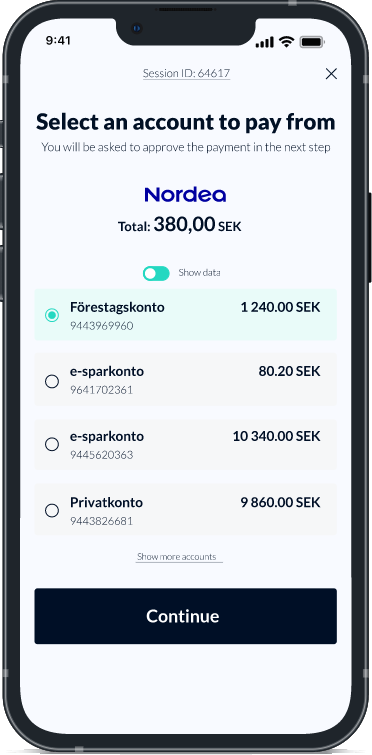

When using Finsharks recurring payment, your business present a modern, mobile first Flows for payment initiation. The customer authenticates with an SCA like nemId, bankId or their bank login. They select what account to withdraw from and approves of the amount and dates displayed on a summary page.

That’s it! No more late payments, no expired cards and no more Jedi skills required for configuring a recurring payment.

Sylvia Hölscher

Experienced in business development and sales. 5+ years working in the tech industry with a focus on FinTech, RegTech and anti-money laundering.

Connect with me on LinkedIn!