Payments

Creating a subscription-based payment strategy.

Subscription Business Models have been on the rise for many years. The most obvious ones are probably found in the music and movie industries, but we also see major shifts in more traditional manufacturing industries like the car, gadget or health sectors. The reasons are simple; business owners and investors alike see great potential and security with a steady stream of recurring revenue.

What subscription based model that suits your business can vary, naturally. Unlocking certain features, pay by usage, access to content and memberships are all examples of potential setups. Need some inspiration? We’ve curated two great videos on the topic.

Why everything is a subscription and why investors and users love it.

6 types of Subscription business models.

Consider this when selecting recurring payment methods.

There are nuances and different needs for each business setting up a subscription based model. Once you’ve decided what type of model would fit your business, a crucial step is to know how to get paid. In the end, providing value for your customers is just one part. Getting paid is and equally important part of the puzzle.

There are multiple options for recurring payments as we’ve written about before. Choosing between these can seem daunting at first, but to help you out we’ve created this list of variables to consider. Based on the needs of your business, some things are more important than others. Other things might be tightly connected to the type of subscription you’re aiming for.

Ready? Here we go!

Sign-up date.

What date a customer signs up on might have an impact on the pay dates and the amount to be paid in the first (partial) month.

Will you bill the client for a calendar month, or running 30 days? Running 30 days might mean that your income doesn’t resonate with monthly costs on your end, but calendar months might mean that the first month is not a full 30 days.

With the open banking solution, it’s possible to set up two separate payments in the same consent flow; one for the remaining days this month, and then the recurring payment for every subsequent month.

Autogiro has got a built-in cutoff date, so any new customers approving recurring payments after the 16th won’t be billed until the month after, and that payment will be bigger than the agreed amount since it’s more than 30 days.

Trial period.

On a similar note, you might want to offer new customers a free trial period for a set amount of time. With card or open banking payments, you can then set up a delayed recurring payment that kicks in when and if your customer is still active after the trial period is over.

Geographic coverage.

Need a solution that works globally? Then card payment is the only viable solution. If possible, you could also offer other solutions in local markets.

Cost.

With thousands of recurring payments happening every month, even relatively small fees can become a major liability for the bottom line. The potential extra work of offering open banking payments even in just some markets can pay off in the long run,

Usability.

Literally, no one wants to print out, sign and mail a form to initiate a recurring payment. Even if that might seem extreme, you neither want to lose a potential customer just because they can’t bring themselves to pick up their wallet. There’s a good reason why mobile payments, digital wallets, and direct payments are increasing in popularity.

Upgrading / Downgrading.

Give the power to the customers to control their spending and usage of your service by letting them upgrade or downgrade their plans. What happens to their consent when the payment plan is changed? Card details can be saved, but users still need to go through secure consent management.

Contract length and churn.

Churn is a natural part of any subscription economy. It still can give you chills down your neck. Some card payment methods have built-in churn with expiring agreements or expiring cards. Avoid that at all costs!

Canceling a subscription.

What happens at cancellation? Users can keep access until the last day, or you pay out whatever excess they’ve paid. With payments through open banking, a closed loop means payouts are fast, cheap, or even free.

Start using Finshark’s modern recurring payments.

It should come as no surprise that recurring payments with Finshark are superior to any other payment methods available. For fixed recurring payments made within the Nordics, no other option is really needed.

A perfect flow.

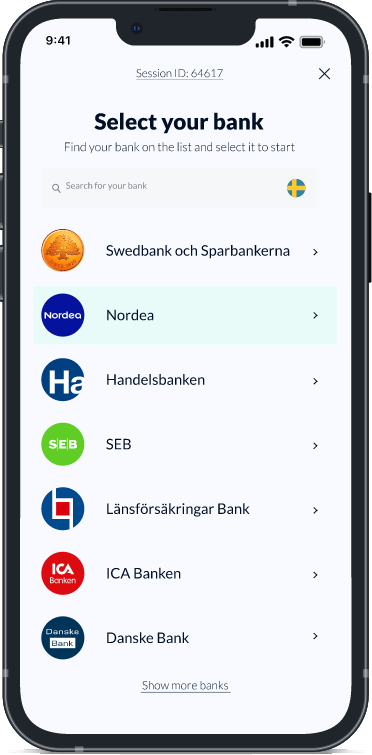

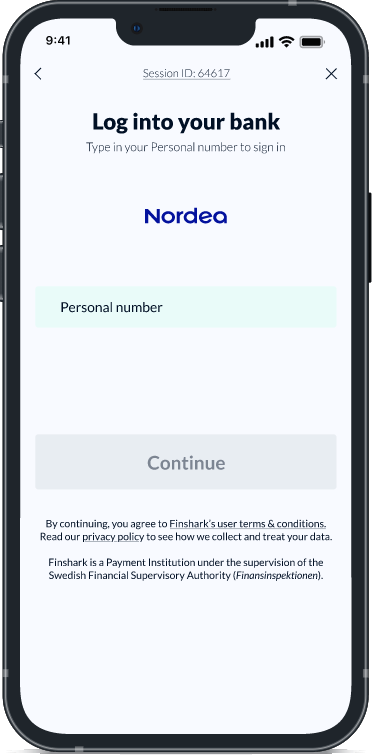

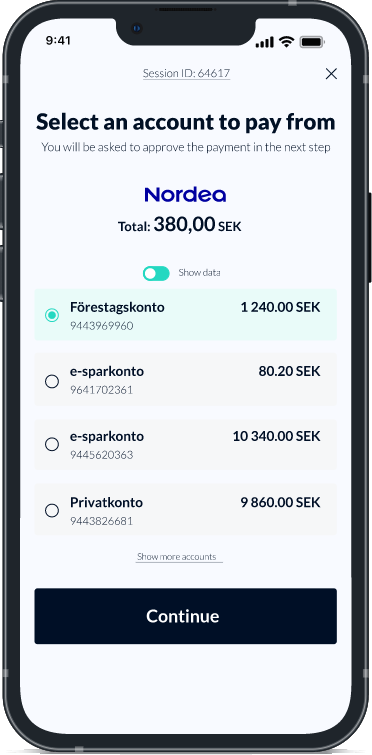

When using Finshark’s recurring payment, your business presents modern, mobile-first Flows for Payment Initiation. The customer authenticates with an SCA like nemId, bankId, or their bank login. They select what account to withdraw from and approve the amount and dates displayed on a summary page.

That’s it! No more late payments, no expired cards, and no more Jedi skills required for configuring a recurring payment.

Linus Logren | E-commerce payment specialist

Payment specialist in the e-commerce and marketplace sector. A decade of experience working with e-commerce as a business owner, marketeer and consultant.

Connect on LinkedIn!