Payments

Cards or instant payments? Merchants, read this.

Cards or open banking, which method is best for online payments? That is a burning question for many of the merchants we have been chatting with lately.

Cards have been around forever, but they are certainly not perfect as they haven’t been designed for online shopping. On the other hand, open banking payments are digital-first and offer very quick and pleasant checkout journeys for customers as well as several great benefits for merchants, being much more convenient (i.e. cheaper) and reliable when it comes to getting paid (i.e. faster settlements). Let’s see how the legacy and the new are when compared to each other.

Online card payments: why are they so expensive?

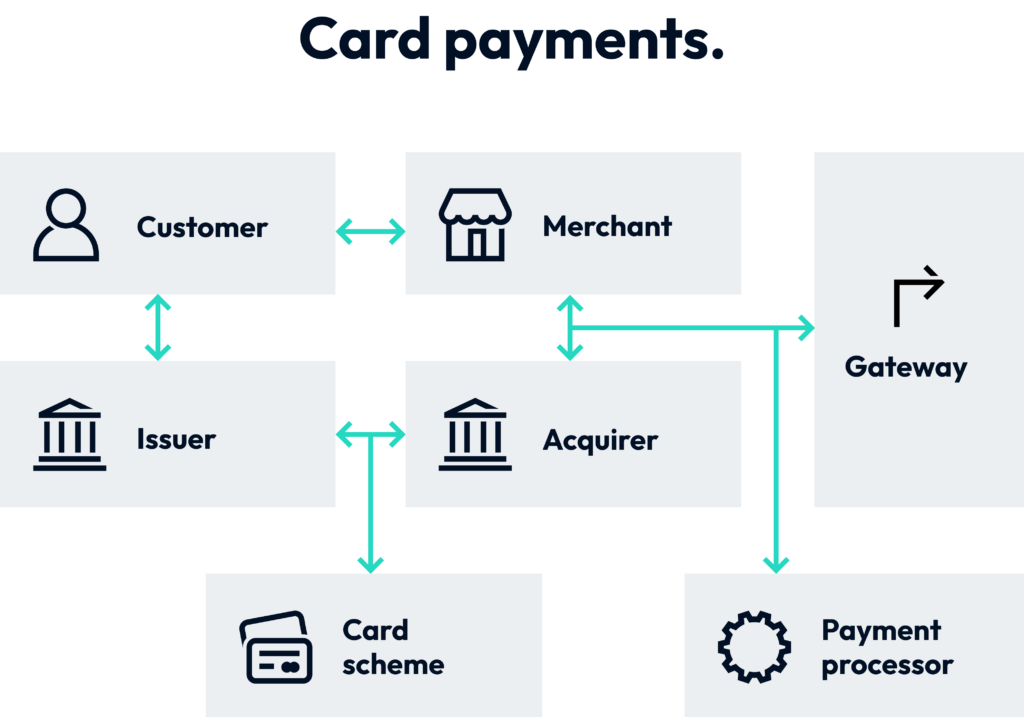

Every time somebody buys from an online store with a debit/credit card, a long chain of events is automatically set in motion. Several parties get involved and play their part before the payment ends up in the hands of the merchant. But who are these additional players? Let’s shed some light on the process.

The customer and the merchant.

The two most obvious parties participating in the exchange are the merchant and the customer (also known as the cardholder): the merchant selling a service or a product, and the cardholder willing to acquire it. However, to be able to accept card payments, the merchant must entrust a gateway and an acquirer.

The gateway.

Every business accepting credit and debit cards needs some sort of payment processing service. Payment gateways oversee the front-end tech of the online shop collecting payments and card information and forwarding them in an encrypted manner to the acquirer for processing.

The acquirer and the issuer.

The merchant’s and the customer’s banks, also referred to as the acquirer and the issuer, play a facilitating role in the payment process. The acquirer is the bank or the financial institution that processes card payments on behalf of the merchant, it accepts funds from the sale once the card is authorised and transfers them into the merchant’s account. On the other hand, the issuer provides credit and debit cards to the customer on behalf of the card brand network and pays the acquirer for the purchase made by the cardholder.

The card scheme.

One of the most obvious actors in the payment ecosystem is the card network, which acts as an intermediary between the acquirer and the issuer defining fees, standards, and processing transactions. Card networks match the card information obtained by the acquirer with the relevant bank, enabling the acquirer to receive the payment authorised.

The different parties involved in an online payment interacting with each other.

Card payments, the process behind the curtains.

Several actions happen in the background within the few seconds it usually takes for a card payment to go through. The process can be divided into two main stages: authorisation and settlement.

Authorizations.

First, the card details provided at purchase and the amount must be verified by the issuer. This takes a few seconds, and it happens in the background as the customer waits for the payment confirmation.

- The payment information (card provided by the customer at checkout) is transmitted to the merchant through the gateway.

- The merchant forwards these details to the bank (the acquirer) responsible for processing the payment.

- The acquirer sends all the payment information to the customer’s card network (Visa or Mastercard, for instance).

- The card network contacts the issuer (customer’s bank) and forwards the information to approve the transaction.

- The issuer checks the card details (such as the card number and the CVV code) to ensure that the transaction is not fraudulent. The customer’s bank also controls that there are sufficient funds in the associated account (or credit if a credit card has been used for the payment) to cover the purchase.

- If everything checks out, the bank accepts the transaction and sends an authorization code through the card network to the acquirer, which in turn communicates with the merchant. The acquirer reserves the amount on the customer’s account.

- After receiving the confirmation, the merchant finally provides the customer with the acquired product or service.

Settlements.

The second part of card processing is the settlement stage. It involves the merchant, the acquirer, the card network, and the issuer. Through the many exchanges happening among the different parties, several fees are charged to the merchant.

- Usually, at the end of the business day, the merchant sends all the card transactions to their acquirer, either directly or via a payment gateway.

- The acquirer confirms each authorization and sends them via the relevant card network to the issuer.

- The issuing bank pays the acquirer via the card network which credits the acquirer the funds owed to the merchant, minus any processing fees.

- The acquirer finally releases the funds to the merchant.

The settlement process for merchants usually takes a few business days. Sometimes, some payment processors require up to a week.

How much does it cost for merchants to accept cards?

As you can see, card processing is not as straightforward as one might think. Through all the various exchanges, the payment actors involved all charge some fees. For merchants, all this translates into non-negotiable costs eroding their profit.

Depending on the chosen provider, a business accepting card payments can be charged a fee between 1.5% and 3.5% of the amount being paid on every transaction just to process customer payments. This is just an estimation as there are many variables and factors that can concur.

The amount merchants should expect to pay when accepting credit and debit cards can vary depending on several factors, such as the card network, the acquirer, the method used (i.e. online vs in-store), and the transaction volumes and values. Also, beside the costs per transaction, there might be additional monthly charges. It all depends on how many parties (and if any additional ones) are involved in the online payment process described above.

What fees must be paid to accept cards?

Below are just some examples of the potential fees merchants could encounter when accepting credit and debit cards (this is not an exhaustive list and at the same time, some of these might not be applicable to every scenario):

Interchange fees.

The interchange fee goes directly to the card issuer. Credit card companies may charge higher interchange fees since online transactions are considered riskier.

Payment processor and gateway fees.

Payment gateway and payment processor fees can be charged at a flat monthly rate or per transaction.

Assessment fees (card brand fees).

Assessment fees to credit card networks are paid to be able to accept certain cards. This charge is usually based on monthly sales.

Authorisation fees.

Authorisation fees exist to cover the cost of card authorisations (i.e. checking the customer’s card details to make sure they are valid).

Chargeback fees.

When customers do not approve or do not recognise a card payment, they might ask for a transaction to be reversed. This can happen quite often (especially in certain industries). Chargeback fees are the costs incurred every time a transaction is challenged by a customer.

Open banking is here to upgrade payments.

In the last few years, we have witnessed a progressive wave of financial changes which magnitude is affecting not only banks but potentially any company selling online. One of the most significant effects caused by open banking and the European Union’s revised Payment Services Directive (PSD2) – the ground-breaking regulation which shook up the financial status quo – is the dramatic and long-awaited transformation of the payment sector.

Adopted to support innovation while focusing on payment safety, PSD2 recognised the possibility for Payment Initiation Services (PIS) and their providers (PISPs) to borrow and leverage the infrastructures of banks and the capabilities offered to their customers by online banking. To end users, this essentially means that when they shop online, they can now connect their bank accounts to the store they are buying from and authorise instant transfers of funds to pay for the things they acquire.

Boost checkouts with data.

Payment Initiation is a great opportunity both for businesses and customers, but it really works wonders when combined with the Account Information Service (AIS). These are just some of the many advantages of combining data and payments during checkouts:

Merchants can automatically access their customer’s account data to detect any money laundering or any other suspicious activity in real-time and without adding any extra steps to the checkout journey.

- Having access to accounts, merchants can deliver convenient and seamless payment journeys removing any superfluous steps as customers are directly linked to their online banking account for automated authentications, authorizations, and checkouts.

- The added layer of financial intelligence enables merchants to deliver one-click checkouts to their returning customers.

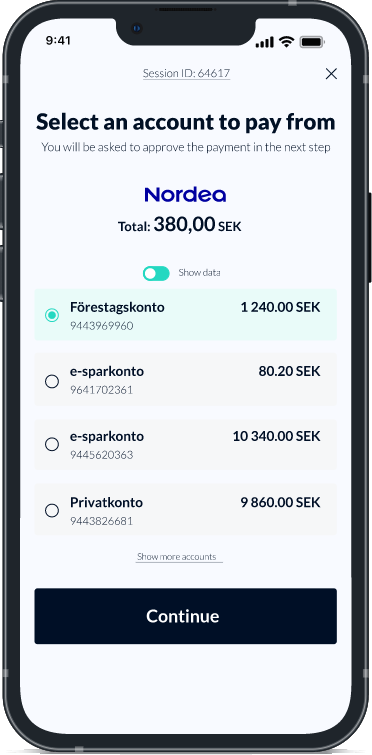

- Customers get full visibility of the available funds in their bank account(s) as they purchase, so they can pay accordingly.

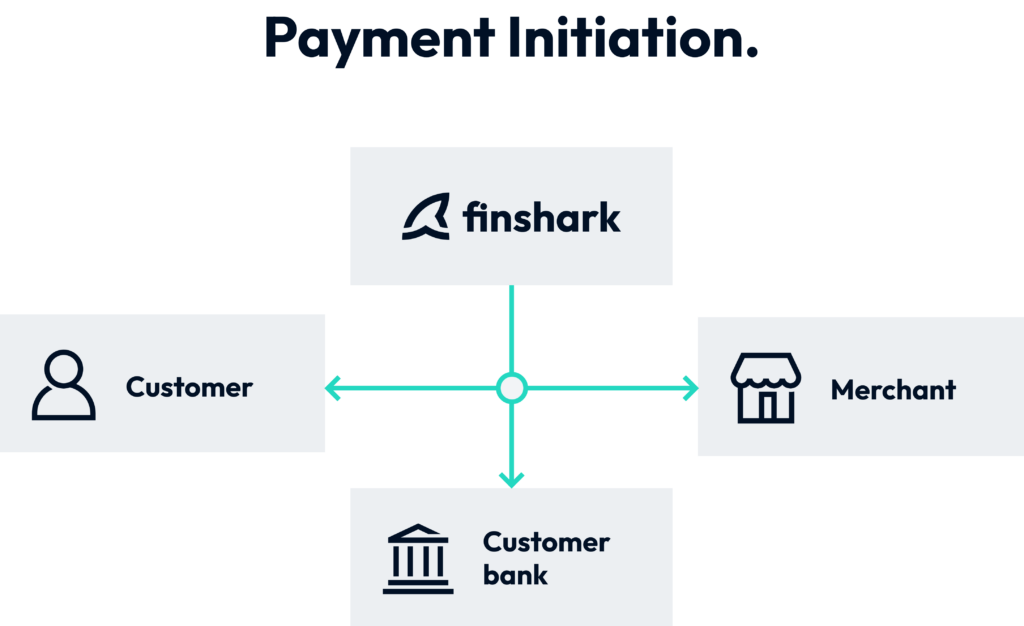

From several facilitating parties to just one.

Completely independent from card schemes, open banking payments (also referred to as account-to-account payments, direct bank transfers, bank-to-bank payments, online banking payments or instant bank payments) provide a solid, streamlined addition to the range of payment methods merchants can currently offer to their customers.

In the card payment flow we have described above, the main parties (customer, merchant, issuer, and acquirer) all interact with each other passing information among themselves. The card network acts as an intermediary facilitating these exchanges and managing certain functions such as clearing and settlements.

Let’s see how the open banking payments process is different.

In this approach, the PISP (Finshark) facilitates an interaction only involving three main parties: the customer’s bank, the customer, and the merchant. The merchant’s bank plays no role in the exchange and simply receives funds once the payment is settled.

Finshark handles everything from authentication and authorisation to all the instant decisions and exchanges described for the card payment process, making card schemes redundant (along with payment processors and gateways), and allowing the customer bank to pay directly into the merchant’s account through a more agile process.

Therefore, all the interchange fees required by the traditional intermediaries are completely removed from the equation, leaving merchants with better margins to enjoy while drastically shortening the settlements of funds in place for card payments (since the actual transfer of funds is initiated at purchase).

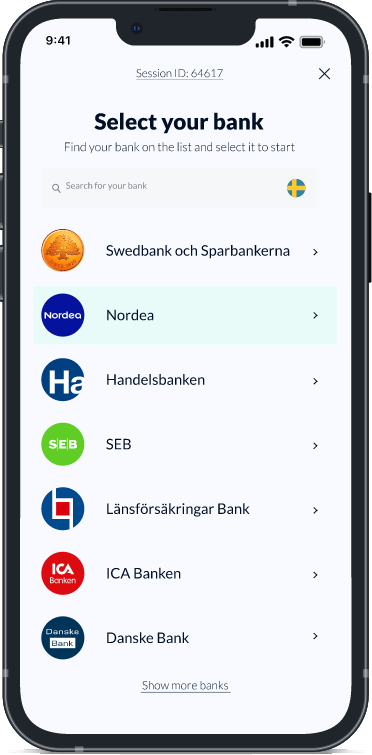

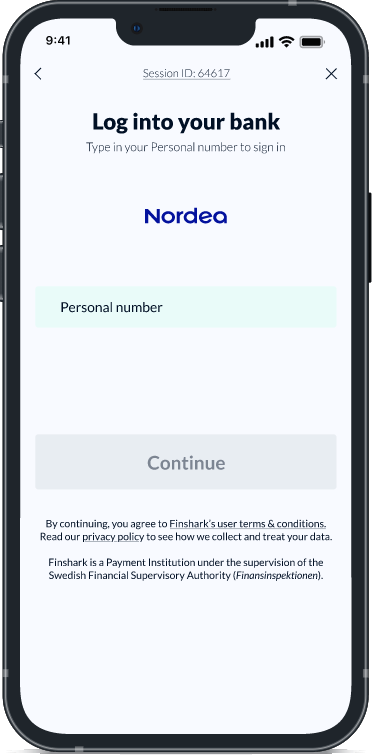

How does it look for customers?

At checkout, customers log into their online banking service directly from the store portal to authorize a request for sending funds to the merchant (this is also known as a push payment). The payment request travels through the PISP which then exchanges information with the customer’s bank, initiates a payment from the customer’s account, and sends the money via the interbank payment network directly to the merchant’s business account.

From the customers’ perspective, everything happens in just a couple of steps: they log into their bank, pick the account they wish to pay from, and confirm the payment, authorising the transaction at the same time.

No middlemen, no fees!

Let’s see how the traditional payment fees are removed by open banking payments.

Interchange fees.

The interchange fee is a payment made directly to the card issuer. Cards have no place in this flow; they are removed altogether so are their associated charges.

Payment processor and gateway fees.

No payment gateways nor payment processors are needed here so their fees do not apply.

Assessment fees (card brand fees).

No cards, no card fees!

Authorisation fees.

Same as above. Association fees are also removed.

Chargeback fees.

Customers won’t be inputting their card information and sending them to a third party as they just need to log into their online banking service and authorise a transfer directly from there (with BankID if they are buying from Sweden). Hence, fraudulent chargebacks are drastically reduced as there is no intermediary involved in the payment. Funds are moved directly from the customer’s account into the merchant’s, who gets to control and decide what happens with them after a transfer is made. Since chargebacks cannot happen, nor can the fees attached to them.

Faster settlements for merchants and certainty of getting paid.

One of the biggest drawbacks of card payments is unquestionably settlement times. The required merchant’s batching tasks, the clearing functions performed by the acquiring bank and the card network, as well as the acquiring bank’s funding processes, all need to be finalized before a card payment is completed. This unavoidably delays the final settlement of funds for merchants, which can take up to a week from the purchase date.

Also, due to certain circumstances such as fraud or chargebacks, card payments might fail to process only after a sold product has already been shipped, or a purchased service consumed, leaving the merchant in need of a cash buffer to recover from the incurred loss.

By removing any intermediary layer and taking advantage of instant payment schemes, account-to-account payments can become the perfect method to drastically reduce the settlement times merchants currently have to stand, also assuring payments are in the bank before a product or a service is provided.

So, what’s going to be? Cards or open banking?

Open banking is not after cards. It was created to provide smart and more competitive alternatives for consumers.

Cards will certainly not disappear overnight as they are a well-established method for customers to pay. However, in a market where PISPs can leverage and enrich financial data to power a new generation of modern, faster, and safer payments, it is no wonder that more and more companies are adding open banking to the checkout methods they offer – bypassing the traditional intermediaries, their costs, and the legacy issues still affecting the business of getting paid online.

Therefore, the question for merchants should not be which of the two methods to offer their online customers. Instead, they should start wondering: “Why not start offering both?”.

Nicola Spera | CBO

A jack of all trades with a passion for usability, fresh pasta and breezy payment flows.

Connect with me on LinkedIn!