Payments

3 legacy issues wiped out by instant payments.

For years, standing orders, direct debits, and card on file have been used to collect repeated payments such as subscriptions, memberships, installments, bills, and recurring fees. However, just because these options are well established, that doesn’t mean they are perfect.

The traditional methods in place to enable repeated payments (direct debit, standing orders, and debit/credit cards) can pose several challenges to companies accepting them such as high fees, chargebacks, long settlement times, and risks of fraudulent activities. In particular, cards do expire, get lost, revoked, and their spending limits can cause payments to fail inevitably leading to subscriptions being canceled.

If you are thinking “there must be a better way” as you read this, you are in luck! There is in fact another option available on the market.

1. Payment intermediaries are not free.

To accept debit or credit card repeated payments, merchants must pay a percentage on each processed transaction. With millions of payments happening every year, businesses keep on losing big chunks of revenue margins to third parties such as card operators and payment gateways.

The first main advantage of the new generation of recurring payments is that they can be easily set up and owned by any company. Indeed, the traditional intermediaries (like card networks) are completely removed from the payment flow as the transfers of funds are handled and processed automatically by APIs directly connecting the customer’s bank with the merchant’s business account.

2. Cards get lost, bank accounts don’t.

Failed payments can cause subscriptions to be paused or even canceled. In the industry, they call it “involuntary churn”. It is like stopping customers as they are handing money at the cash register and inviting them to question their commitment to not only the current but also any future purchase they already agreed on. The consequences can be dire as the recurring revenue is lost along with the paying customers.

Cards are the familiar way to pay for many individuals, but for merchants, they are a big liability as repeated payments can fail for various reasons:

- Out-of-date billing information

- Expired or canceled cards

- Maxed-out spending limits

- Lost or stolen physical cards

- Network errors

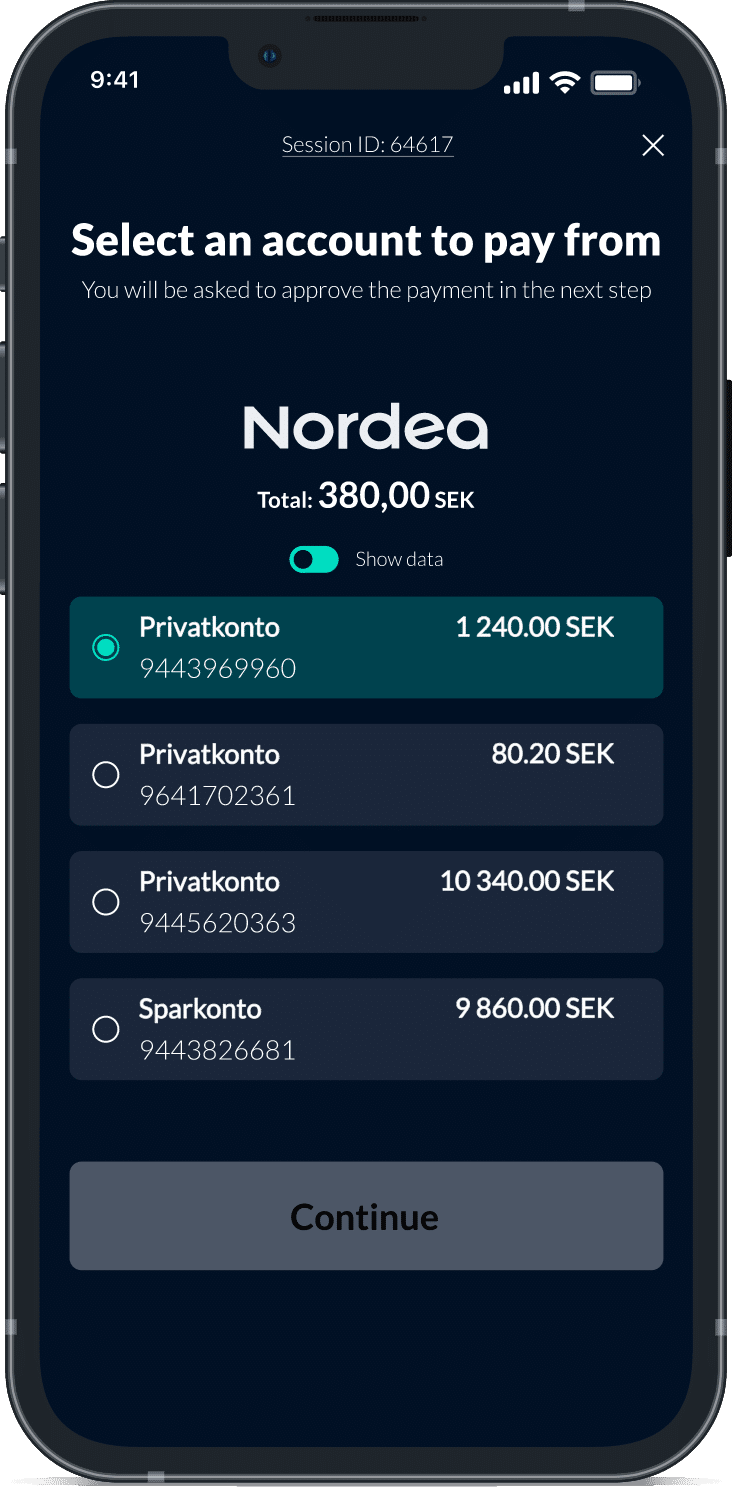

On the other hand, with open banking recurring payments, the customer authorization is required only once (during the setup) and any following transaction is scheduled and triggered automatically depending on the initial agreement between the customer and the merchant/business.

3. Bad experiences are very expensive in the long term.

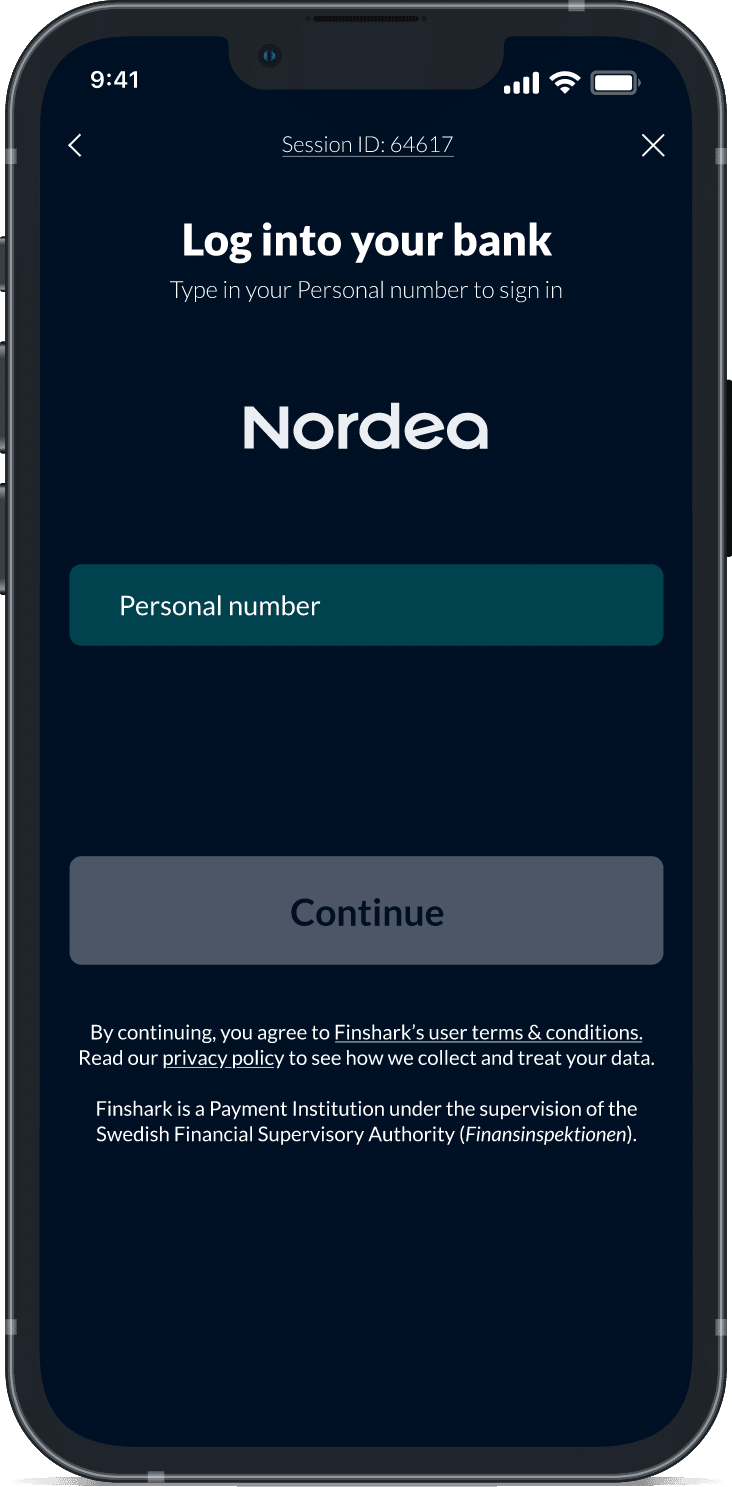

With legacy options, customers are forced to manually enter their payment details, such as card information (for card payments when the risky card on file practice is not available as an option) or bank account numbers (which are quite hard to remember). For open banking recurring payments, only top-of-mind information is asked in the process, like login credentials for online banking.

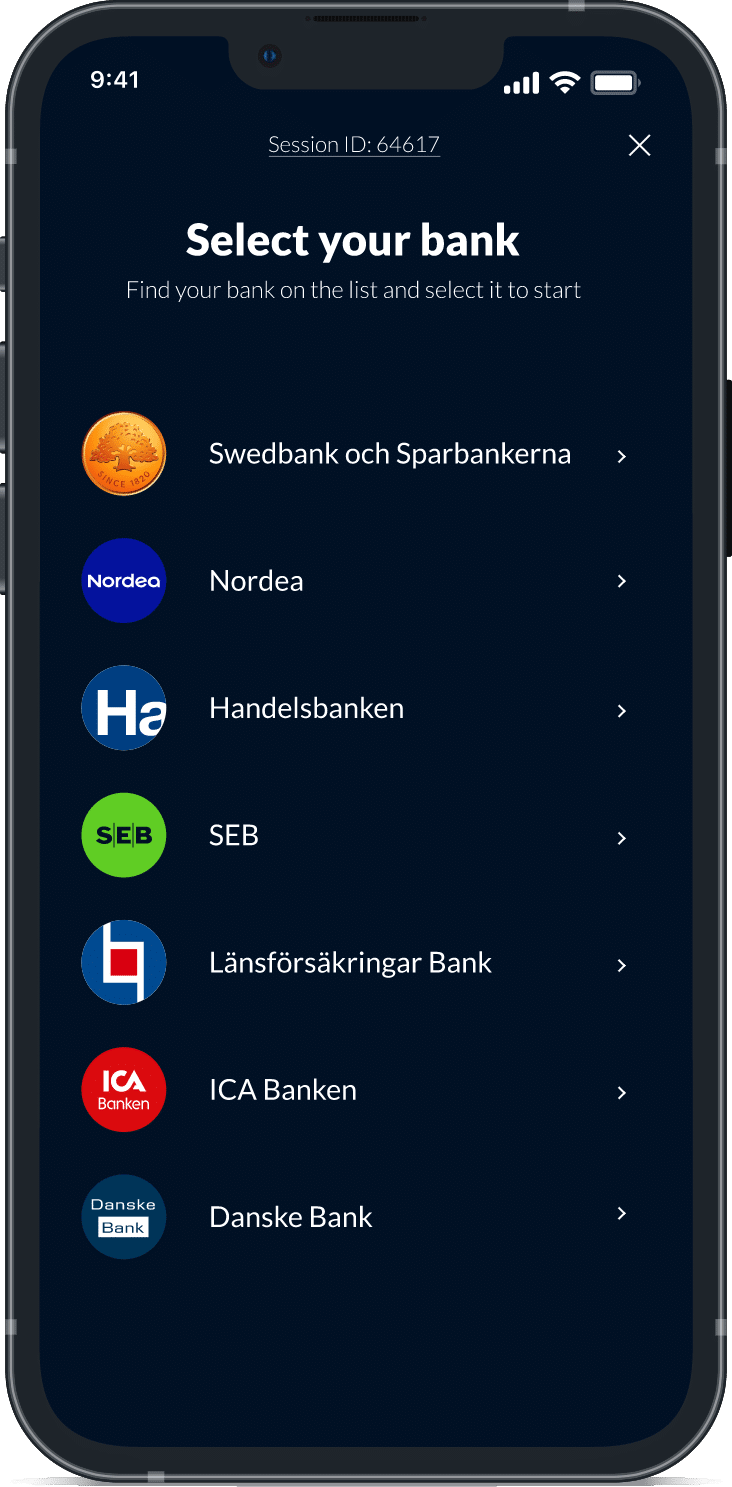

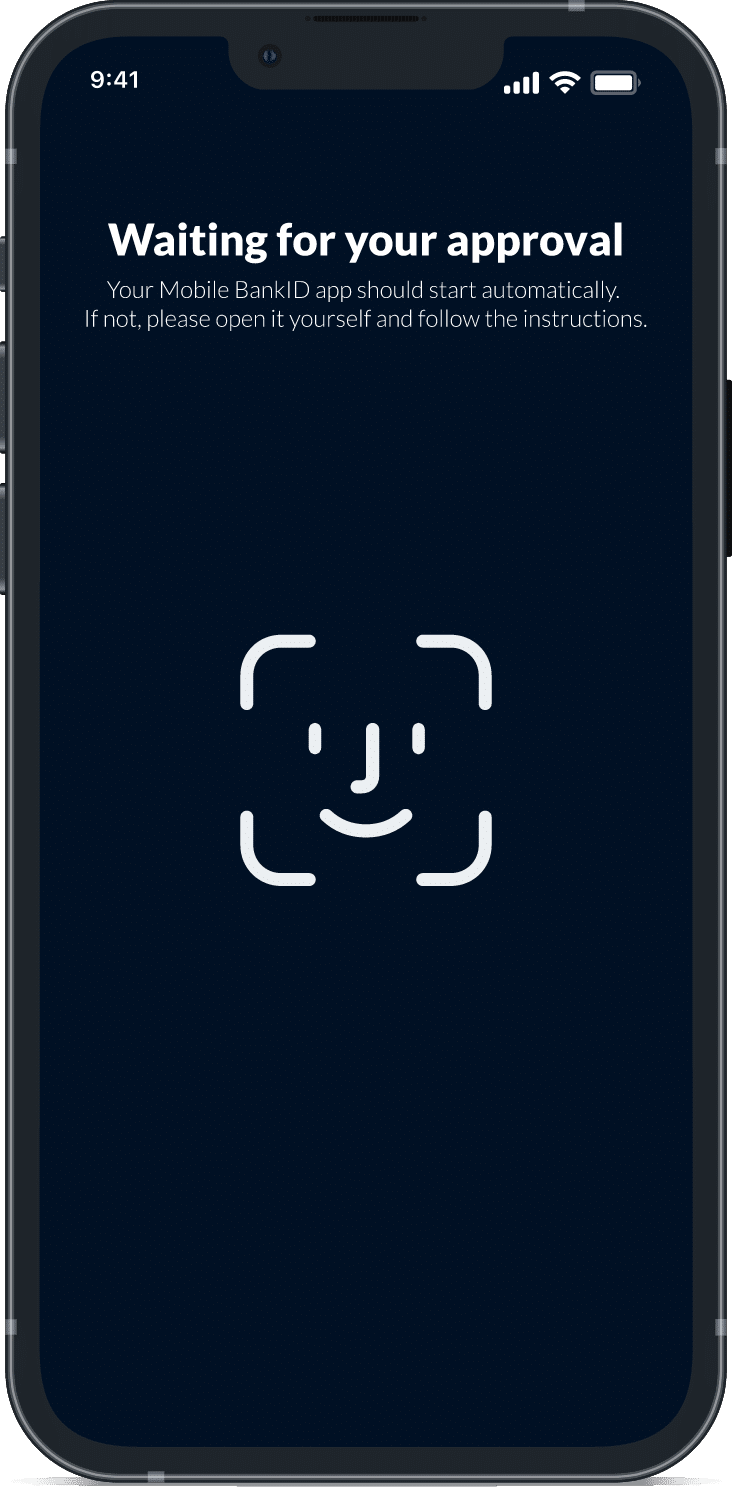

To authorise the full payment schedule, customers only need to go through three simple steps; choose their bank directly from the merchant interface, authorise the payment from their banking app or BankID, if they are based in Sweden, and get redirected to the merchant page as funds get transferred. All in one breezy flow.

To many businesses, such as subscription models and memberships – but also countless companies in the financial services sector, for instance – recurring revenue is essential to survive. The payment experience can really affect loyalty and make or break the relationship with customers.

Open banking recurring payments, the new kid on the financial block, can help fix what is broken with the traditional repeated payment offer providing new and improved experiences and benefits both for companies and their customers.

Nicola Spera | CBO

A jack of all trades with a passion for usability, fresh pasta and breezy payment flows.

Connect with me on LinkedIn!